Canadians are shopping online more than ever before. Unprecedented growth in the ecommerce landscape has ushered in major changes in what consumers want and need from online retailers.

The pandemic has reinvented the way we live – and how we shop. As a merchant, it can be challenging to stay current with the evolving behaviours, expectations and desires of consumers. Our latest research will help you understand Canadian online shoppers today – so you can meet and exceed their expectations tomorrow.

Get to know the evolving Canadian ecommerce market

Canadian online shopping accelerated at a rapid pace, and this trend can be seen across all online shopping segments. The average basket spend value for online purchases increased by 14 per cent in 2021 compared to 2019.1

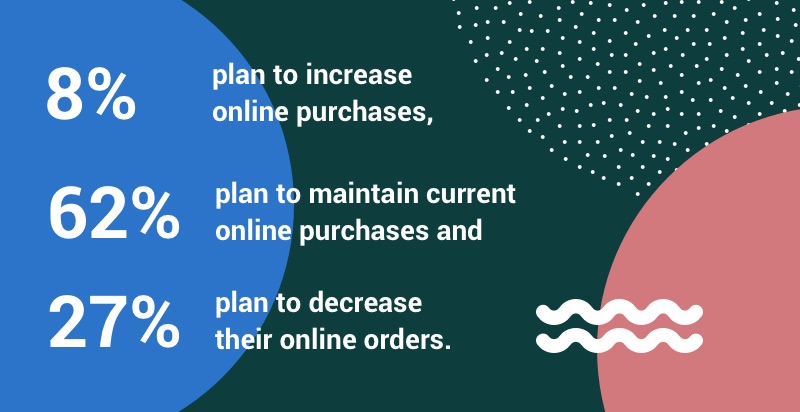

Canadian online shoppers show no signs of slowing down as we move into a post-pandemic world. Canadians are becoming more reliant on ecommerce – out of convenience and necessity. Eight per cent of Canadian online shoppers expect to make more purchases online from the U.S. in 2021, with 62 per cent saying they’ll maintain their current rate of online purchasing.2

Grow your business north of the border. Talk to an expert about the Canadian e-commerce opportunity.

Contact usWhat Canadian online shoppers are buying

Clothing, books and computers and electronics are still the top product categories for Canadians shopping online from the U.S, but consumers are branching out. Product categories such as home decor and office supplies saw growth compared to 2019.3 To capitalize on these new trends, some merchants are actively diversifying their product offerings.

Growth opportunities

Growth opportunities

There are many growth opportunities within the market that Canadian ecommerce merchants can look to capitalize on. The Hyper+ shopper segment has grown because of the pandemic, for the most part. While some of that increase may be short lived, as some return to in-person shopping, the pandemic has introduced people to more convenient ways of shopping. To cater to what shoppers see as their new normal, merchants should focus on things like delivery/receiving options.5

During the pandemic, growth in online sales was attributed to all generations as it became the norm. That said, when it comes to the future sustainability of that level of ecommerce, then it is the Millennials and Gen X generations that will be the biggest contributors while Boomers and Pre-boomers will likely do less ecommerce shopping and revert to more in-person shopping.

Offering incentives to online shoppers like coupon codes, flexible payment options, themed subscription boxes, pre-ordering, inventory visibility across store channels and recurring deliveries can encourage them to click buy. Features and experiences like these can also offer attractive perks – such as free shipping and faster delivery – which are factors that motivate Hyper+ shoppers. Other segments are also starting to explore these types of services too, so there’s a great opportunity for merchants to acquire new customers – while also boosting retention among their existing customer bases.

Meet Canadian consumers’ evolving expectations

As Canadians spend more time and money online, their expectations for a positive customer experience increase. A good customer experience comes down to transparency and clarity for many shoppers. Free shipping continues to play an important role in consumer decision making, but there are other key factors that influence where Canadian online shoppers choose to shop. Here’s how to turn their heads and exceed their expectations:

Make returns customer friendly

How your business handles returns matters a lot to your customers. Behind cost of shipping, free returns were cited as the second most influential factor that customers considered when choosing where to shop online (61 per cent). Offering flexible returns was also top of mind, at 44 per cent.6

Disappointing customers on returns has consequences. In fact, 63 per cent of shoppers have reported abandoning their carts over concerns about the return policy. Standard concerns typically revolve around cost, unclear policies, lack of return options and a lack of clear and transparent communication.7

Consider the environment

With climate change discussions and concerns, customers are making decisions based on companies’ environmental values and impact. 37 per cent prefer shopping with retailers who are reducing their carbon footprint. Gen Z and Millennials are paying particular attention to what retailers are doing to lessen their impact on the environment and investing their dollars with retailers who reflect these values.9

Prioritize your delivery/customer experience

How your business manages deliveries, and the quality of your customer experience is very important. 58 per cent of Canadian consumers are influenced by speed of delivery and 46 per cent are motivated by the retailer providing an expected delivery date.11

- 28 per cent are motivated to shop with retailers who use a carrier that ensures their package is securely delivered.

- 17 per cent prefer to shop with retailers that use carriers that allow them to set delivery preferences.

- 16 per cent prefer to shop with those using carriers that offer convenient pickup locations.12

Be sure to use your delivery partnership to your advantage and keep customers informed about their delivery options.

When it comes to customer experience, going the extra mile for your customers and showing them your appreciation helps you stand out. 46 per cent of Canadian consumers are influenced by loyalty or rewards programs – especially millennials (48 per cent). Promotional content can also motivate shoppers and keep your brand top of mind. 38 per cent say they were influenced in their choice of retailer by a promotional email and 16 per cent were influenced by an advertisement/flyer in the mail.13

Get an edge on your competition

As a retailer, knowing how your customers (and potential customers) behave – and what they expect out of an online shopping experience – is paramount. Meeting and/or exceeding their expectations can give you a competitive edge and position you nicely for the next stage of your company’s growth. Canada Post is committed to helping merchants succeed in this way.

Sources:

1-13 Canada Post. 2021 Canadian Online Shopper Study, p. 21-205, April 2021

Stay in the loop

Get the latest ecommerce and marketing insights, tips and more articles like this – delivered to your inbox.

Subscribe

Growth opportunities

Growth opportunities